year end tax planning ideas

If you are not yet a TaxConnections Member start today right here. Read it and ask questions if you dont understand something.

Printable Tax Checklists Tax Printables Tax Checklist Small Business Tax

Claim Bonus Depreciation for 2020 Asset Additions.

. Keep workers on the payroll Initially the CARES Act authorized the employee retention credit ERC for businesses that kept workers on the books throughout the pandemic in 2020. This is usually an excellent strategy for taxpayers except for wealthy. Review portfolios for low basis stock and consider implementing a capital.

Here are 10 ideas for small businesses to consider. The important thing is to TAKE ACTION now and send your best year-end tax planning tips to us so we can shine the spotlight on you and your year-end tax planning expertise. Here are 10 ideas for small businesses to consider.

If you wish to establish this type of plan you must form and fund the plan prior to the filing of your. Typically year-end tax planning consists of accelerating deductions delaying income and maximizing contributions to tax-deferred accounts. New Look At Your Financial Strategy.

Unless a law amending tax law is passed before the end of 2021 these ideas can help you maximize your tax savings. Remember that the Tax Cuts and Jobs Act of 2017 is the law currently in force. No one likes to receive a surprise tax bill on April 15 th.

Be sure to check the IRS website for updates. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. While these ideas still may be beneficial for many people the tax increases included in proposed legislation may cause some taxpayers to go a different direction this year.

Here are six year-end strategies for business owners to consider. Year-end Tax Planning Ideas Tax laws change every year. 5 Strategies to Implement Before 2022.

The limit for contributions in this type of plan for 2021 is 58000 or 25 of your self-employment compensation whichever is lower. The 2020 CARES Act provision that allowed the deduction of 300 in charitable donations with no. Identify all vendors who require a 1099-MISC and a 1099-NEC.

Deposit your receipts before year end and delay payments on expenses until 2022. End Your Tax NightApre Now. You are responsible for the information on the tax return you sign.

Quick Year-End Tax Planning Ideas Defer income and accelerate deductions. Claim Bonus Depreciation for 2020 Asset Additions Thanks to the Tax Cuts and Jobs Act TCJA. But before you start thinking about 2021 do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider at least from a planning perspective to take advantage of before year-end.

Income acceleration may also include Roth IRA conversions. Small business owners still have time to make tax planning moves to lower their 2020 federal income tax bills and possibly lay the groundwork to save taxes in future years. 6 ideas for year-end tax planning for 2021 Tax Deductible Accounts.

Minimize capital gains tax. Claim Bonus Depreciation for 2020 Asset Additions. Then the CAA extended the ERC through June 30 2021 with some enhancements.

Identify all vendors who require a 1099-MISC and a 1099-NEC. This video provides strategies for investment considerations tax planning charitable giving family meetings and more. Here are 10 ideas for small businesses to consider.

2021 Top 10 Year-end Tax Planning Ideas for Individuals 8. Small business owners still have time to make tax planning moves to lower their 2020 federal income tax bills - and possibly lay the groundwork to save taxes in future years. A proposed surcharge on wealthy taxpayers continues to gain momentum amongst lawmakers and might become effective in.

Here are ten ideas for small businesses to consider. Year-End Tax Planning Ideas For Your Business As 2021 winds down here are some ideas to consider in order to help manage your small business and prepare for filing your upcoming tax return. As the new year approaches its a good time to review your retirement plan beneficiaries.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Beware of tax preparers or information services that advertise to reduce your tax burden through confusing tax strategies. Tax Year end planning Small business owners still have time to make tax planning moves to lower their 2020 federal income tax bills and possibly lay the groundwork to save taxes in future years.

Obtain tax identification numbers TIN for each of these vendors. Verify Withholding and Estimated Tax Payments. Get Started and Learn More Today.

Review your portfolio With the potential for increase in the long-term capital gains rate you may need to consider what this means for a concentrated stock position and how this can impact your diversification strategy. The various options of tax-deductible accounts are important tools for saving for the future as. Visit The Official Edward Jones Site.

Clients look to financial professionals to help them organize their financial affairs and deliver experiential alpha especially as the end of year approaches. AARP Money Map Can Help You Build Your Savings. Our Savings Planner Tool Can Help With That.

Year-End Tax Planning Ideas for Your Business As 2021 winds down here are some ideas to consider in order to help manage your small business and prepare for filing your upcoming tax return. The Key Wealth Institute recently released its top 10 year-end planning ideas for 2021. Accelerate income and defer deductions.

The end of the year presents a unique opportunity to self-reflect about your personal financial planning situation. Life changes such as a divorce marriage or death of a loved one may require you to make updates to retirement accounts pensions and wills as necessary. Ad Need To Plan Funds For A Large Purchase.

Obtain tax identification numbers TIN for each of these vendors. Thanks to the Tax Cuts and Jobs Act TCJA 100 first-year. Claim Bonus Depreciation for 2020 Asset Additions Thanks to the Tax Cuts and Jobs Act TCJA 100 first-year bonus depreciation is available for qualified new and used property thats acquired and placed in service in calendar year 2020.

Below is a list of Top 10 2020 ideas that you should consider as published by AccountingToday. Dont forget to take your 2021 Required Minimum Distributions RMDs. Ad 5 Best Tax Relief Companies of 2022.

End Of Year Contribution And Distribution Planning For Tax Favored Accounts Https Www Kitces Com Blog End Of Year Contribution Di End Of Year How To Plan Ira

Today We Welcome A Guest Post From Katie Tejada Get To Get To Know Misunderstood Business Tax Deductions Business Tax Deductions Business Tax Tax Deductions

Start Off The New Year With Clean Books Preparing For Year End Clean Book Financial Checklist Preparation

Year End Tax Planning Strategies And Tips Fire Book Book Burning Apple Books

Year End Tax Planning 10 Ideas For The Restaurant Owner Operator Https Track Keithjonescpa Com Ed878170 C Debt Relief Programs Debt Relief Tax Debt Relief

Year End Tax Planning Tips For Women Professionals 2020 Edition Retirement Money Personal Finance Lessons Personal Finance Advice

Three Critical Year End Tax Planning Moves Money Making Business Money Saving Tips Planning Checklist

Today We Welcome A Guest Post From Katie Tejada Get To Get To Know Misunderstood Business Tax Deduct Business Tax Deductions Business Tax Financial Education

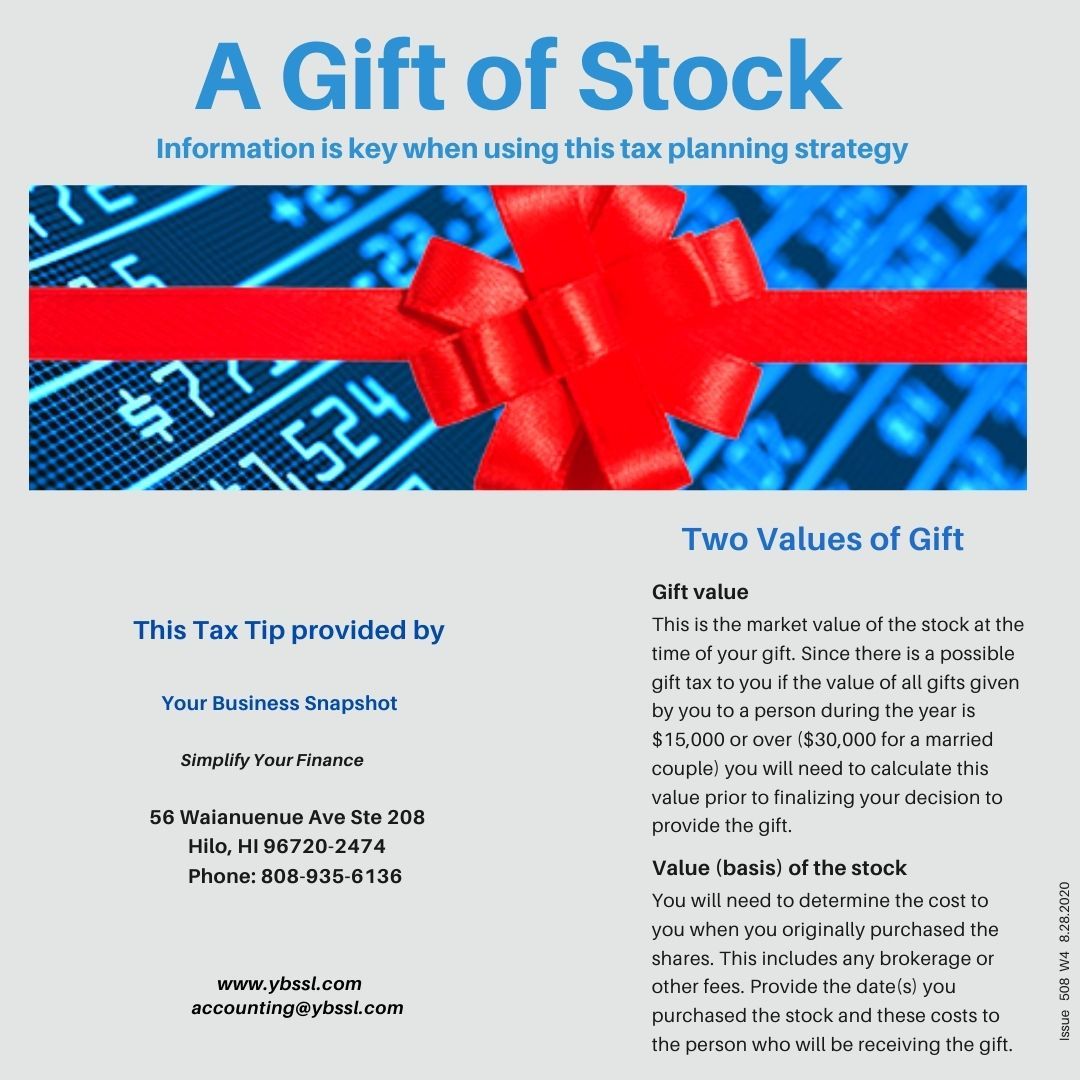

A Gift Of Stock Stock Information Gifts Stock

Tax Tip 4 Tax Deductions Owe Taxes Married Filing Separately

Tax Planning How To Plan Investing Budgeting Finances

5 Easy Tips For Making Tax Season A Breeze Passionate Storyteller Public Speaker Bookkeeping Business Tax Prep Checklist Tax Prep

Learn How To Tackle Your Bookkeeping In Under 30 Minutes Grab My Year End Tax Planning Guide For Free Meredith Rines Bookkeeping Planning Guide Bookkeeping Templates

How To Organize Your Receipts For Tax Time Visual Ly Small Business Tax Tax Time Receipt Organization

How To Reduce Taxes And Profit Towards The End Of The Year Saving Tips Savings Strategy Tax

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Business Tax Small Business Tax Small Business Bookkeeping

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Saving Money Budget Managing Your Money Money Mindset

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax